Future of Manufacturing in Europe

The EU Commission presented an Explorative and Future-oriented study of for Internal Market, Industry and SME. As a part of this study ‘The European Reshoring Monitor’ measured the return of previously offshored jobs to Europe. The outcome of this study was presented in the report ‘Eurofound (2019), The future of manufacturing in Europe, Publications Office of the European Union, Luxembourg.’

European Reshoring Monitor

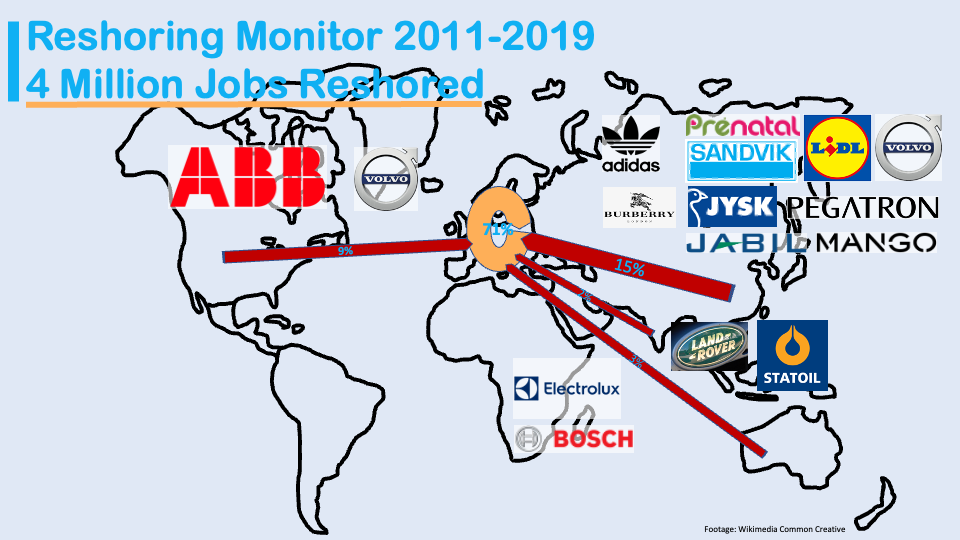

During the period of 2011-2019, the European Reshoring Monitor measured the return of offshored activities of 250 companies with a total of 4 million reshored jobs. Next to the measurement of the number of jobs, also the reasons were captured of these reshored initiatives.

The frequency of the reasons mentioned were cataloged by our own research research study. We came to the following Top 10 Value Reasons of the 250 re-shoring activities;

- “Made In” Effect

- Production Quality

- Customer Proximity

- Delivery Time

- Industry Automation

- Know-How

- Logistics Cost

- Production Planning

- Labour Cost

- Cost Structure

Reshored from ‘Where’, ‘Who’, ‘What’ and ‘To’

The Trans-Continental 1.2 million, 29% of the total, reshored jobs were mainly generated by large manufacturing corporations offshored in mainly China, USA, Australia and India to Europe. Although other offshored countries were also in scope, but less significant in job numbers.

The Internal EU Market 2.8 million, 71% of the total, reshored job initiatives were mainly generated by large manufacturing corporations who had offshored in mainly Eastern-Europe and to Southern-Europe in the past. The reshoring initiatives were aimed to optimise and consolidate their manufacturing sites in their traditional home markets.

Economics and Value drivers

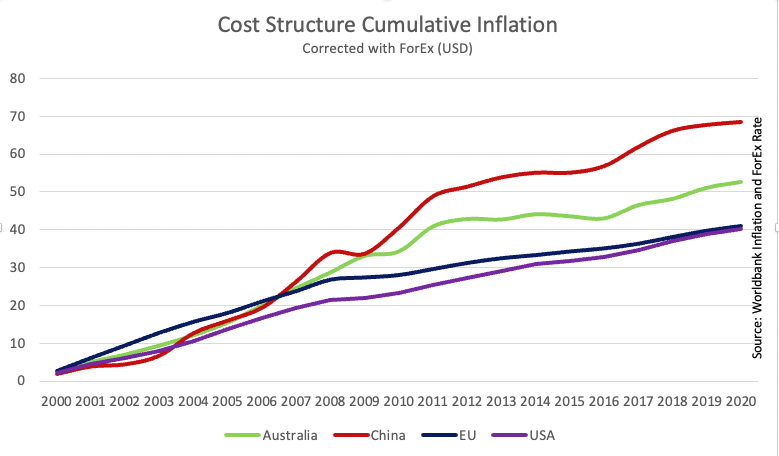

Since the time when Offshoring (across the continents) and Near-shoring (within the continents) started to be prominent and emerged, the business case drivers have been changed. Taking the WordBank data, since the period of the Credit Crisis and Economic Crisis the economics has been changed in terms of inflation and exchange risks, if we take productivity as a constant perimeter. A price change, net inflation of 30% of GDP corrected with Foreign Exchange rates.

But also reading the other reasons mentioned, which goes beyond the monetary impact. Such as Innovations alike Industry 4.0, Quality, Proximity, Customer Preferences, Supply Chain Management constraints amongst others.

The Challenge to Consolidate with Reshoring

A Strategic Objective of corporates to keep their products and service competitive for their markets and customers. In our experience as consultants in strategic services, not an easy decision as for most of the companies a significant project. Although a very nice cheat sheet, where the top 10 reasons listing, nicely illustrates, what makes a reshoring project as a succes!

In our experience, the failure to achieve these Strategic Objectives are caused by the lack of Know-Doing the transition to make it happen successfully;

- Know-How may have disappeared, capture and create the knowledge on what we have learned from the initial offshore;

- Know-How to combine repackaged Know-How for the Reshore Initiative, with the New Know-How of the Innovations;

- Know-How to avoid the same pitfall, in other words, create this Know-How sustainable and mobile.

The Solution is to Implement Know-Doing by a Knowledge Eco-system, resulting in improved performance

We can help you with implementing a Knowledge eco-system through a process of, Awareness, Evaluation, Implementation and Management.

Resulting in an Improved Performance with a Knowledge Framework implementation.

Interested to hear more about… realising Know-Doing!

Contact us through phone, email or.. our website, To plan an Introduction meeting, which is free of charge!